IRR The Internal Rate of Return

Posted By: Nileestate

- IRR The Internal Rate of Return .. Commercial Real Estate in Egypt

- With multiple methods of calculating the internal rate of return, it is difficult to know the best way to your investment strategy in Egypt.

- Understanding the importance of the internal return rate of IRR is also essential for successful commercial real estate investment.

- High IRR understanding and IRR not supported

- What is Levered IRR?

- What is Unlevered IRR?

- IRR Levered vs Unlevered

- IRR Levered vs Unlevered: Pros and Cons

- Advantages of high IRR

- High IRR defects

- Advantages of Unapproved IRR

- Unsupported IRR defects

- What is the best IRR scale for you?

- Factors to consider when choosing between IRR Levered and Unlevered

- When choosing between IRR levered vs unevered, there are many factors investors must take into account. The cost of borrowing, potential returns on investment and the investor's risk tolerance are fundamental considerations. In addition, investor capital structure, market trends and investment objectives can play a role in decision-making. Ultimately, choosing an Internal Rate of Return (IRR) scale that is compatible with investment strategy and objectives is crucial.

- How to calculate both IRR measurements

- Both enhanced IRR versus non-booster can be calculated using discounted cash flow analysis (DCF). The discounted cash flow method uses cash flow forecasts to estimate future investment cash flows, which are then deducted to the present value using the discount rate. The resulting figure represents IRR for investment. To calculate the high internal rate of return, interest payments on borrowed funds are also taken into account

- Common errors to avoid when calculating internal rate of return

- One of the most common errors made when calculating the internal rate of return is not to calculate the time value of money correctly. In addition, accurate IRR calculations can lead to consistent cash flow projections, miscalculation of discount rates, or failure to include all relevant cash flows. It is important to ensure that all cash flows are calculated correctly and that the discount rate is applied appropriately.

- Non-booster vs booster

- Make use of IRR to maximize returns

- Explain how the internal rate of return can be utilized to maximize returns

- The role of leverage (borrowed funds) in commercial real estate investment

- Summary

IRR The Internal Rate of Return .. Commercial Real Estate in Egypt

If you are a seller or investor of commercial or administrative real estate in Egypt, you know that achieving the highest possible return is essential to your success. Understanding the concept of internal rate of return (IRR) will be critical.

Internal rate of return is a basic measure that helps you assess the profitability of your business real estate investments.

With multiple methods of calculating the internal rate of return, it is difficult to know the best way to your investment strategy in Egypt.

We will illustrate the differences between high IRR versus unpaid IRR and provide examples of how each of the two methods can yield higher returns in commercial real estate investment. We will also demonstrate the advantages and disadvantages of each style and give real-world examples to support you in making well-calculated investment decisions.

With your reading of the subject you will better understand the internal rate of return (IRR) and how it can be leveraged to help you maximize returns on commercial and administrative real estate. So let's dive in and find out how to move your commercial and administrative real estate investment to the next level.

The importance of the internal rate of return in commercial real estate investment

The internal rate of return (IRR) is an important measure of commercial real estate investment because it measures the profitability of the investment during its period of ownership. The time value of money is an important tool for measuring and comparing different investment opportunities.

Investors and sellers in commercial real estate can determine whether the investment will achieve their financial goals and ambitions by calculating the internal rate of return.

- IRR is very useful in assessing the risks involved in investment. A high internal rate of return refers to a more profitable investment but may also be associated with significant risks. By considering both the internal rate of return and the risks involved, investors can make informed decisions about their investments and increase their returns while reducing risk

- The additional benefit of using the internal rate of return in commercial and administrative real estate investment is that it allows investors to determine the appropriate capital structure for the investment. High internal return rate and unsupported internal return rate are calculated based on different assumptions about the investment capital structure. Understanding the differences between the two rates can help investors choose the right funding strategy to maximize profits.

Understanding the importance of the internal return rate of IRR is also essential for successful commercial real estate investment.

It enables investors to make informed decisions, assess risks and increase investment returns.

High IRR understanding and IRR not supported

When assessing the profitability of commercial and administrative real estate investments, two types of internal rate of return (IRR) are commonly used IRR lifter and IRR unsupported. Internal rate of return (IRR) measures can be valuable tools in helping investors identify investment opportunities that offer the highest potential returns.

What is Levered IRR?

Definition of high internal rate of return: a measure that takes into account financing or debt associated with a particular investment. Essentially, it represents the expected rate of return on investment after considering any debt or leverage used to finance the investment. Levered IRR assumes that the investor has borrowed money to invest in the property and takes into account interest payments associated with this borrowing.

What is Unlevered IRR?

An unsupported rate of internal return is a measure that only considers the return on investment without any financing or debt included. The unpaid internal rate of return represents the expected rate of return on investment if no funding is used and only takes into account cash flows resulting from the investment itself.

IRR Levered vs Unlevered

By comparing the high internal rate of return, consideration must be given to the potential benefits and disadvantages of each approach. A high internal rate of return can be more attractive in cases where the cost of borrowing is lower than the potential return on investment. However, benefiting from investment can also increase risks as high interest rates or other economic factors can negatively affect investment returns.

An unpaid internal rate of return can be a more conservative and less debt-based approach that reduces investment risk. However, it may also lead to lower gross profits due to the lack of loans to increase the return on investment.

Finally, the choice between the high internal rate of return versus the non-leverage will depend on different factors including the investor's risk tolerance, borrowing cost and specific investment details by understanding the differences between the two types and the advantages and disadvantages of each, investors can make informed decisions about the IRR approach best suited to their investment strategy.

IRR Levered vs Unlevered: Pros and Cons

Choosing between IRR levered vs unevered can be crucial in commercial real estate investment while both methods have advantages and disadvantages, there are certain circumstances in which one method may be more appropriate than the other.

When choosing between a high and unsupported internal rate of return, it is necessary to take into account investment details such as property type, market trends and investor's financial objectives. Investors must also take into account risk tolerance and the amount of capital available.

In the end, the choice between IRR levered vs unevered will depend on a variety of factors. It is important that commercial real estate investors carefully assess these factors and choose the approach that best suits their investment strategies and objectives.

Advantages of high IRR

A high internal rate of return can provide investors with a higher potential return on their investments, as borrowed funds can be used to inflate the amount of capital available for investment and increased investment can increase an investor's purchasing power and acquire more real estate. It can also provide tax benefits through discounts on interest payments

High IRR defects

An important obstacle in the high rate of internal return is the increased risk of borrowing funds for investment if the return on investment does not meet or exceeds the cost of borrowing, the investor may suffer significant losses.

Benefiting from investment can also lead to higher interest rates making investment more expensive. Finally, borrowing money to invest can be risky if the property does not function as expected resulting in foreclosure or other negative consequences.

Examples of high internal rate of return in commercial real estate investment

An example of benefiting from commercial real estate investment is the purchase of a residential complex in the amount of 5 million pounds with an advance payment of 1 million pounds and the financing of the remaining amount of 4 million pounds.

If the property generates Pound500,000 in cash flows in a given year, the high internal rate of return will take into account interest paid on the loan of Pound4 million and any other borrowing expenses, allowing the investor to determine the real rate of return on his investment.

Advantages of Unapproved IRR

An unsupported rate of internal return can be a less risky method of investment because it does not involve borrowing money for investment but can be particularly useful in a high interest rate market where the cost of borrowing may exceed potential returns on investment.

An unpaid internal rate of return can also provide a more accurate measure of investment profitability as it only takes into account the cash flow generated by the investment itself.

Unsupported IRR defects

The main disadvantage of an unsupported internal rate of return is that it may result in lower returns than leveraged investment as there is no borrowing to inflate the return.

So an unpaid internal rate of return can reduce an investor's purchasing power as they may only be able to afford smaller investments or lower properties.

.

Examples of Unapproved Internal Return Rate in Commercial Real Estate Investment

An example of an unpaid rate of internal return on commercial real estate investment may involve buying a property directly without borrowing. If the property generates 500,000 pounds of cash flow in a given year, the unpaid internal rate of return represents the return on investment without considering any interest payments or other borrowing expenses.

This approach can provide a more accurate picture of a property's profitability but may result in lower returns than leveraged investment.

What is the best IRR scale for you?

Choosing between IRR levered vs unevered can be a challenge for commercial real estate investors. There are many factors that investors need to consider before choosing the right internal rate of return measure. The cost of borrowing, market trends, investor's risk tolerance and potential returns on investment are some of the key considerations. Ultimately, investor investment objectives and capital structure must also be taken into account when determining the measure of internal rate of return that fits their investment strategy.

Factors to consider when choosing between IRR Levered and Unlevered

When choosing between IRR levered vs unevered, there are many factors investors must take into account. The cost of borrowing, potential returns on investment and the investor's risk tolerance are fundamental considerations. In addition, investor capital structure, market trends and investment objectives can play a role in decision-making. Ultimately, choosing an Internal Rate of Return (IRR) scale that is compatible with investment strategy and objectives is crucial.

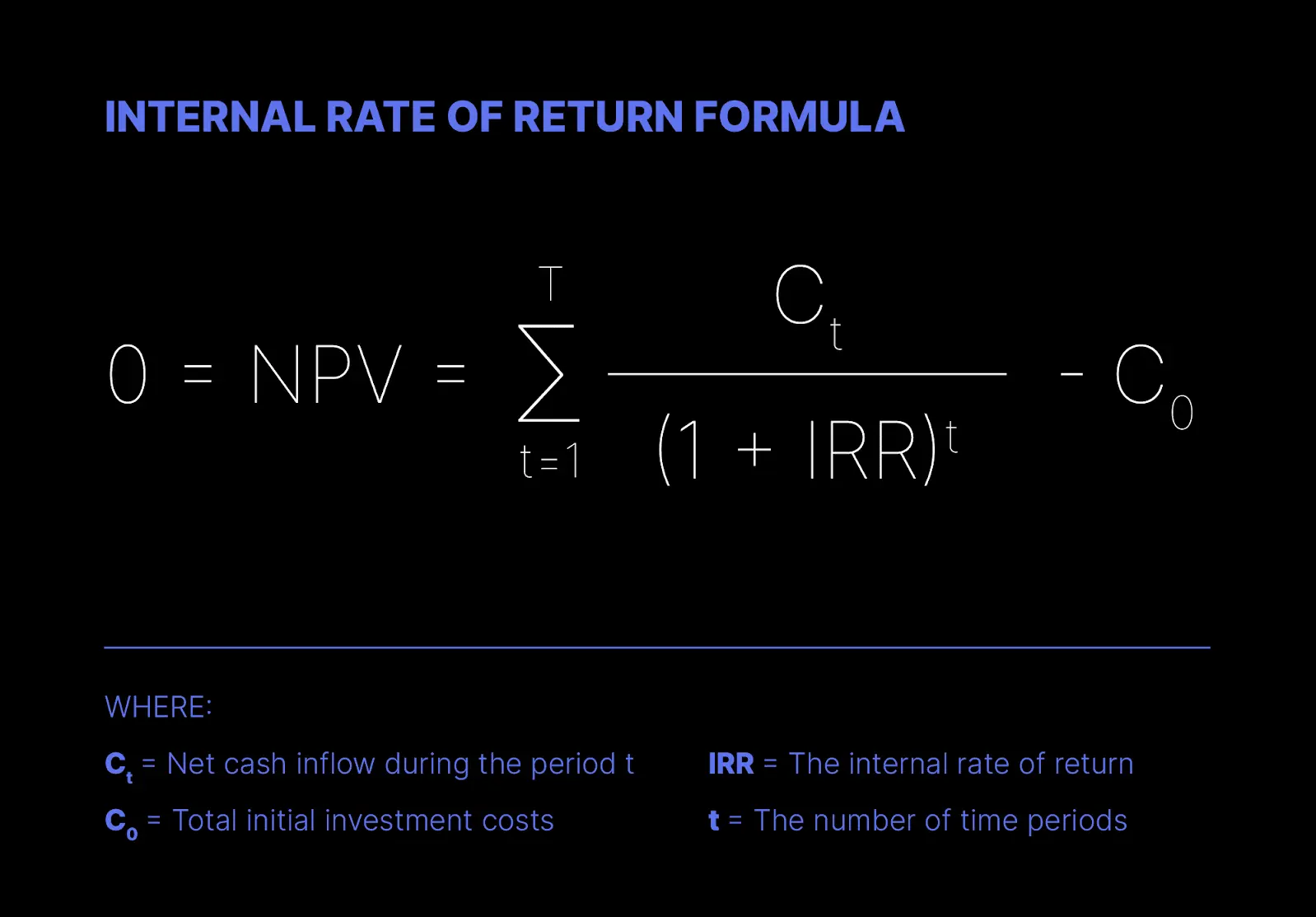

How to calculate both IRR measurements

Both enhanced IRR versus non-booster can be calculated using discounted cash flow analysis (DCF). The discounted cash flow method uses cash flow forecasts to estimate future investment cash flows, which are then deducted to the present value using the discount rate. The resulting figure represents IRR for investment. To calculate the high internal rate of return, interest payments on borrowed funds are also taken into account

Common errors to avoid when calculating internal rate of return

One of the most common errors made when calculating the internal rate of return is not to calculate the time value of money correctly. In addition, accurate IRR calculations can lead to consistent cash flow projections, miscalculation of discount rates, or failure to include all relevant cash flows. It is important to ensure that all cash flows are calculated correctly and that the discount rate is applied appropriately.

Non-booster vs booster

Make use of IRR to maximize returns

Leveraging an internal rate of return can be a valuable tool for investors looking to maximize their returns. However, it is necessary to accurately assess risks and potential returns before deciding to take advantage of investment. Investors should ensure that leverage is in line with their investment objectives, risk tolerance and strategy appropriate to their investment objectives.

Explain how the internal rate of return can be utilized to maximize returns

Leveraging the internal rate of return is an effective way to maximize returns on commercial real estate investment. Investors can increase their purchasing power by borrowing money to invest and acquire more properties than they can without benefiting. Leverage can also inflate return on investment, as borrowed funds can be used to generate larger cash flows.

The role of leverage (borrowed funds) in commercial real estate investment

Leverage plays an important role in commercial real estate investment, as it can provide investors with more important investment opportunities and the potential for higher returns. However, it is important to remember that investment borrowing also comes with increased risk, and it is important to accurately assess risks and potential returns before benefiting from investment.

Potential risks and rewards for leverage use to increase internal rate of return

Using leverage to boost the internal rate of return can offer significant rewards, such as increased purchasing power and higher returns. However, it also comes with increased risks, such as high interest rates, the potential for increased costs, and the potential for financial instability. As such, it is necessary to carefully consider the risks and potential rewards of using leverage to maximize the internal rate of return and ensure that it is aligned with the investor's overall investment strategy and objectives.

Summary

In conclusion, when it comes to maximizing your commercial real estate revenue, understanding the differences between a high versus unpaid internal rate of return is crucial. While a high internal rate of return can provide the possibility of higher returns, it also comes with increased risks and potential costs associated with borrowing. On the other hand, the unpaid internal rate of return is a more conservative approach, making it a suitable option for risk-averse investors.

Choosing the right internal rate of return measure requires careful assessment of investment details, market trends, borrowing costs and an investor's financial objectives. It is also important to ensure that appropriate accounts are used and avoid common errors when calculating the internal rate of return.

Finally, leveraging the internal rate of return can be a powerful tool to maximize returns on commercial real estate investment. However, it is necessary to accurately assess risks and potential returns before deciding to take advantage of investment. Investors must make sure that leverage is in line with their investment strategy and objectives and that it is the right strategy to take risks.

In short, by carefully considering the factors described, commercial real estate investors can decide whether to use a high or unsupported internal rate of return to maximize their returns. Ultimately, the key to the success of commercial real estate investment is a comprehensive understanding of investment details and how to effectively use internal rate of return measures to achieve your investment goals.

0 Comments

Leave Comment